How to Screen and Qualify Tenants

One of the most common questions landlords ask is: "How do I find a great tenant and avoid a bad one?"

Tenant screening isn’t just about choosing someone who can afford rent, it’s about protecting your investment, reducing risk, and ensuring long-term success. But here’s the catch: this process is also the number one source of fair housing complaints in real estate.

At Mesa Properties, we’ve developed a clear, objective screening system that follows all fair housing laws while ensuring we place high-quality tenants who pay on time and take care of your property. Let’s break it down.

-

1. Make Sure You Follow Fair Housing Laws

Many landlords don’t realize that even an innocent mistake in tenant screening can result in a lawsuit, investigation, or fine.

For example, can you deny an applicant based on criminal history? It depends. Can you pull their credit report? Only under certain conditions, especially if they receive government assistance.

There are strict rules on what you can and cannot use to qualify tenants, and failing to follow them can lead to serious consequences.

That is why we take compliance seriously. At Mesa Properties, we have never had a fair housing-related lawsuit or investigation. We do things by the book to minimize your legal risk.

-

2. What Screening Criteria Should I Use?

The key to fair and effective tenant screening is to apply the same pre-set criteria to every applicant. This eliminates subjectivity and legal gray areas. Many landlords only look at credit score and income.

Credit score and income are good starting points, but they don’t tell the full story. We take a holistic approach by evaluating multiple different factors before approving a tenant. This includes:

- FICO score (if allowed by law)

- Verified income

- Rental history

- Eviction history

- Debt-to-income ratio

- Applicable criminal history

This data-driven approach ensures we select tenants who are financially responsible and likely to pay on time in full every month.

-

3. How Do I Avoid Fraudulent Applications?

A shocking 15-20% of rental applications contain false information. We see everything from fake pay stubs and fraudulent landlord references to full on stolen identities.

This is why reliable verification is key. We don’t just take an applicant’s word at face value. We cross-check income records, contact landlords directly, and confirm identity documents with both machine learning and a physical check. We ask for multiple copies of pay stubs and bank statements to catch inconsistencies.

Placing the wrong tenant can cost thousands in unpaid rent, eviction costs, and property damage. Our thorough verification process helps eliminate fraud and protects your investment.

-

4. What Results Can I Expect from a Good Screening Process?

A good screening process helps filter out bad tenants while simultaneously protecting you from fair housing violations. Historically, we have been able to achieve:

- Less than a 1% eviction rate

- More than 99.5% of rent collected in the month it is due

- Hundreds of successful placements every year with more than 99.5% of rent collected in full the month it is due.

We don’t just claim to have a great screening process, we have real numbers to prove it.

Ultimately, tenant screening is one of the most high-risk and time-consuming parts of being a landlord. Between fair housing laws, fraudulent applications, and high-stakes decisions it’s easy to make costly mistakes.

At Mesa Properties, we take the guesswork and subjectivity out of owning rental property. Our proven process, objective criteria, and strict verification methods ensure you get the best possible tenant—without the stress. Let us handle the details so you can own rental property without it owning you.

connect with a specialist

Owner or Renter?

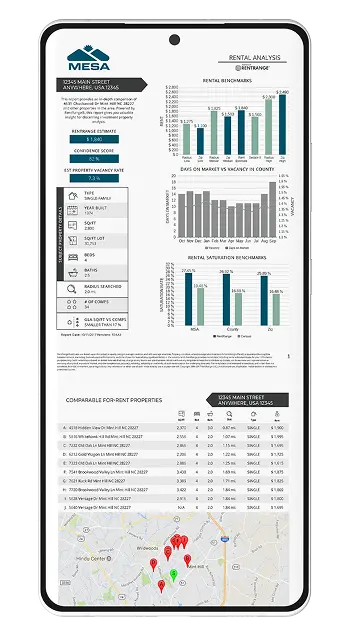

Discover Your Property’s maximum Earning Potential

You can maximize your rental income with our complimentary rental analysis. Our expert insights help you understand market trends, set competitive rates, and position your property for long term success.

What Sets MESA properties Apart?

Expertise and Reliability

At Mesa Properties, we make owning a rental property truly hands-off while keeping you informed every step of the way. From setting the right rent price to handling maintenance, tenant screening, and legal compliance, we take care of everything so you don’t have to. Our proactive approach minimizes vacancies, prevents costly issues, and ensures your property runs smoothly without your constant involvement. With full transparency and clear communication, you’ll always know what is happening with your investment. With Mesa, you can own rental property without it owning you.

Proven Process

At Mesa Properties, process isn’t just a buzzword, it’s in our DNA. Built on two generations of process-driven expertise, our systems create a high-quality experience for every owner and tenant. Steve and Sheryl Shwetz, with over 20 years of franchise management experience, laid the foundation, while Sam and Sawyer Shwetz bring technical experience from the US Navy and JPL to refine operations. This results in a proven, structured process that eliminates the guesswork, delivering reliable property management every time.

let’s chat. schedule a consultation to discuss your property goals.

Where are you located?

If you're looking for a personal rental, please call our office: 909.360.2660

what we do as your Inland Empire & High Desert Property Manager

real-time reviews from our owner & tenant clients

Frequently Asked Questions for Southern California Property Owners

-

How do I get started with property management in ?

Getting started is simple — schedule a quick consultation, and our team will review your goals, walk your property, and prepare your management agreement. We handle onboarding, marketing, photos, and listing setup so your rental is ready fast. -

How do you screen tenants to protect my property?

We use a comprehensive screening process that includes credit checks, income verification, rental history, background screening, and identity verification. This helps ensure responsible tenants who pay on time and care for your home. -

Are there any hidden fees in your property management plans?

No — all fees are fully transparent and disclosed upfront. Our pricing lists every cost clearly, and we never add hidden marketing charges, junk fees, or unexpected add-ons. -

How often will I hear from my property manager?

You’ll receive regular updates, immediate communication for urgent issues, and 24/7 access to your online owner portal for statements, documents, leases, and maintenance updates. -

How do you handle maintenance and repair requests?

We coordinate repairs using vetted, reliable vendors and track all work through our system. Tenants can submit requests online 24/7, and emergencies are handled immediately to protect your property. -

How long does it take to rent out a property in ?

Most well-priced, rent-ready homes in lease within a few weeks. Strong marketing, professional photos, and daily showings help reduce vacancy and maintain predictable cash flow. -

What happens if a tenant pays late or stops paying rent?

We follow a documented late-rent and legal compliance process that includes notices, communication, and enforcement of lease terms. If necessary, we coordinate the eviction process and work to minimize vacancy and financial loss. -

Are you licensed and familiar with local landlord-tenant laws?

Yes — is licensed, insured, and continuously updated on local, state, and federal rental laws. This protects you from compliance mistakes and costly legal issues. -

How do you support out-of-state or busy property owners?

Through proactive communication and 24/7 portal access, owners can monitor finances, approve large repairs, and view property details from anywhere. We manage the daily work so you stay informed without being overwhelmed. -

How do tenants request maintenance and how fast do you respond?

Tenants submit maintenance requests online or by phone, and we respond based on urgency. Emergency issues are prioritized immediately, ensuring safety and preventing property damage. -

How do I use the Rent vs Sell Calculator to decide what to do with my home?

The Rent vs Sell Calculator compares your rental income, expenses, equity growth, and future property value against what you would earn by selling today. Simply enter your home’s value, mortgage details, and rent estimate, and the tool instantly shows which option builds more long-term wealth. -

What does the ROI Calculator help me understand as an investor?

The ROI Calculator breaks down your expected rental returns — including cash flow, cap rate, cash-on-cash return, loan amortization, and appreciation. By entering your financing, expenses, and rent, you can quickly forecast how profitable a property may be over 1 to 30 years.